Find a Land-Based Casino - Gambling by State

Search the USA for Local Casinos, Horse Racing and other Betting Outlets

All of the United States local casinos with directions, website, and contact information on one list or go to the individual U.S. States. Find a place to get out of the house and play nearby, or find the perfect vacation spot for gambling lovers. Unlike other maps, this is the one and only complete, hand-built list. Since Google Maps has trouble identifying them based on different users search criteria, this is a much better human-edited solution, updated periodically. Good luck, and don’t forget to check back for new additions and updated listings in the future.

Choose a State to Find Land-Based Casinos

What States Have Casinos?

Gambling itself is not illegal on the federal level. However, each separate state gets to decide the legality of different gambling forms on its own. The result is that some states have a liberal attitude toward casinos, while some ban gambling completely. At the moment of writing, there are 25 states and territories where commercial casinos are allowed.

By definition, commercial casinos are those establishments owned by private companies. These casinos are permitted by their states to run Class III game operations for real money. In layman’s terms, commercial casinos can have games like slots, blackjack, roulette, and other casino games in their gambling offer. The same kinds of games you can expect to find in legal racinos and riverboat casinos. These sorts of establishments are allowed in more than a dozen states.

There are also some states that don’t consider bingo, pull-tabs, and other non-banked games a form of gambling. The result is that those sorts of games are permitted, while classic casino games are not.

Then, there are Indian casinos. These casinos do not fall under the gambling laws of individual states but are regulated in accordance with the 1988 Indian Gaming Regulatory Act. Right now, there are nearly 30 states with casinos owned by Native American tribes.

Find Your Local Casinos With the Help of MobileCasinoParty

MobileCasinoParty is your source of information for everything casino-related, including details regarding the best casinos in every US state. With our help, you can find the map coordinates of your nearest casinos, as well as get all the contact details needed to get in touch with the casino customer service.-

How to Find the Nearest Casino to Me?

To solve this riddle, you can ask Google for help, searching for terms such as “closest casino to me” or “best casino near me” or something along those lines. You should, however, know that Google’s results are automated, not hand-picked as those you will find at MobileCasinoParty. Our site is where you can find the closest casinos near you by going to the page covering the legality of gambling in your state. -

Racinos and Riverboat Casinos Near Me

Racinos a.k.a. racetrack casinos are permitted in nearly 30 states. Does the state you are currently in belong to this category? You can find it out by reading the MobileCasinoParty page dedicated to your state. The same path you ought to follow if you are trying to find which riverboat casino is closest to your current location.

-

How to Find Indian Casino Near Me?

According to the National Indian Gaming Commission (NIGC), there are nearly 500 casinos operated by 240 federally recognized tribes. To figure out which of those casinos is closest to your current location, the best thing you can do is visit your state’s page on MobileCasinoParty. Each of the state pages contains information about Indian casinos within the state borders. -

Slot Machines and Video Poker Near Me

“How to find video poker near me?” If this question has been on your mind, you can find out the answer at MobileCasinoParty. Just open the page dedicated to your state and look for information about slots and video poker machines. If they aren’t mentioned, it means that your state isn’t too friendly toward these sorts of games.

How Old Do You Have to Be to Gamble?

States with the Gambling Age of 21

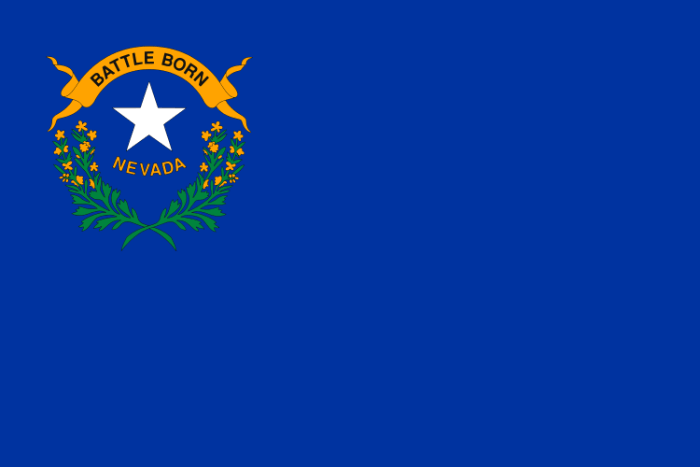

There are 35 states where the minimum age for gambling is 21. One of those is Nevada, meaning that 18 is the gambling age in Vegas. The same is the minimum gambling age in NJ, FL, TX, and so on.

States with the Gambling Age of 18

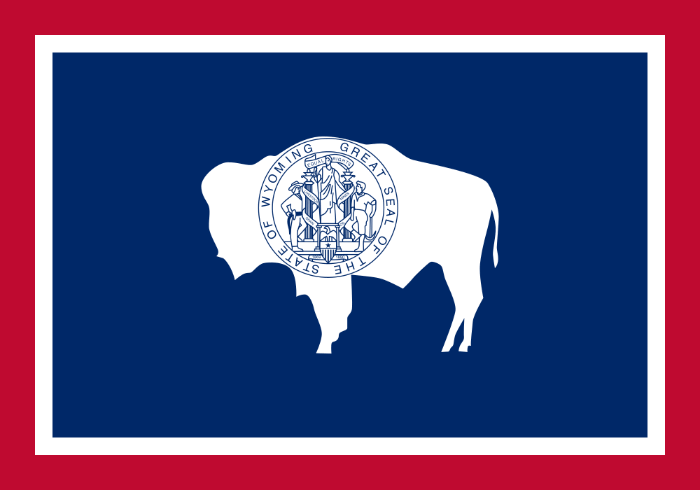

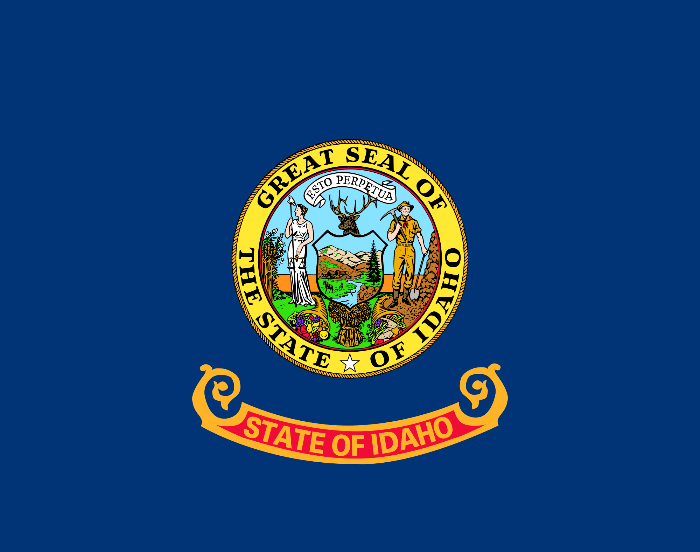

There are only four states in the whole of the United States that have the minimum gambling age set to 18 for all types of casino gambling activities. Those states are, namely, Idaho, Iowa, Minnesota, and Wyoming.

States with the Gambling Age of 18/21

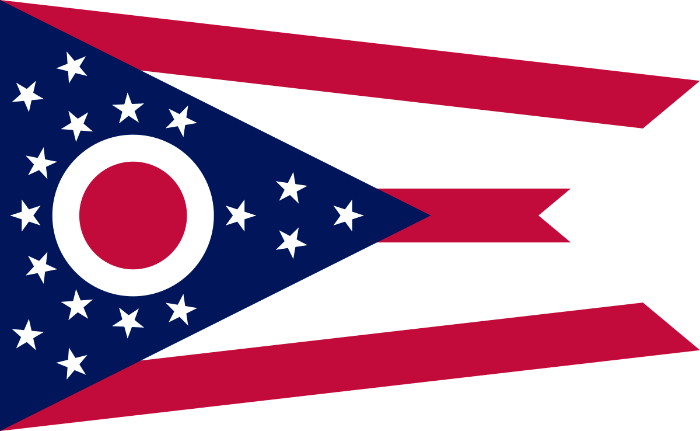

There are 18 states in which the gambling age is either 18 or 21. Some of the states with the 18/21 minimum age include California, South Dakota, and Ohio.

Legal Gambling Age in Tribal Casinos

Tribal casinos usually follow state laws when the minimum gambling age is concerned, although there are some exceptions. In Michigan, the minimum age for commercial casinos is 21, while tribal casinos accept patrons of 18+.

| State | Casino Gambling Age | Poker Gambling Age | Bingo Gambling Age |

|---|---|---|---|

| Alabama | 21 | 21 | 18 |

| Alaska | 21 | – | 19 |

| Arizona | 21 | 21 | 18 |

| Arkansas | 21 | 21 | 18 |

| California | 18/21 | 18/21 | 18 |

| Colorado | 21 | 21 | 18 |

| Connecticut | 21 | 21 | 18 |

| Delaware | 21 | 18/21 | 18 |

| Florida | 21 | 18 | 18 |

| Georgia | 18 (Cruises) | 18 | 18 |

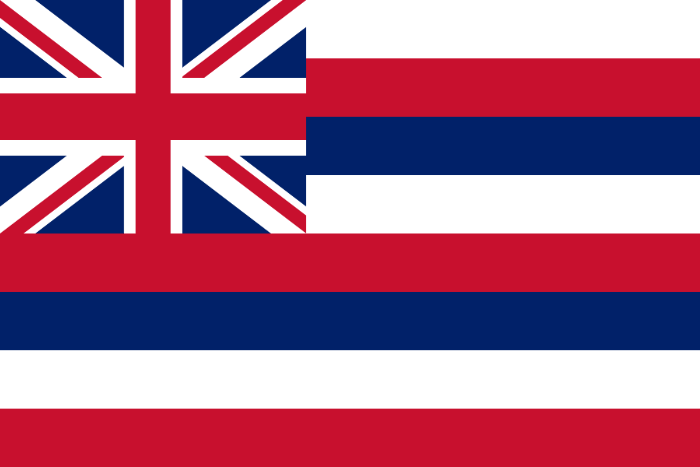

| Hawaii | 21 | 21 | 18 |

| Idaho | 18 | 18 | 18 |

| Illinois | 21 | 21 | 18 |

| Indiana | 21 | 21 | 18 |

| Iowa | 21 | 21 | 21 |

| Kansas | 21 | 21 | 18 |

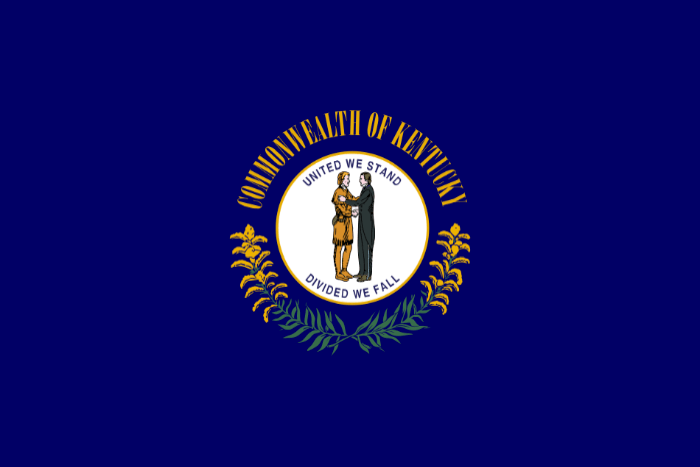

| Kentucky | – | – | 18 |

| Louisiana | 21 | 21 | 18 |

| Maine | 21 | 21 | 16 |

| Maryland | 21 | 21 | 18 |

| Massachusetts | 21 | 21 | 18 |

| Michigan | 18/21 | 32 | 18 |

| Minnesota | 18 | 18 | 18 |

| Mississippi | 21 | 21 | 18 |

| Missouri | 21 | 21 | 18 |

| Montana | 18 | 18 | 18 |

| Nebraska | 21 | 21 | 18 |

| Nevada | 21 | 21 | 21 |

| New Hampshire | 21 | 18 | 18 |

| New Jersey | 21 | 21 | 18 |

| New Mexico | 21 | 21 | No Limit |

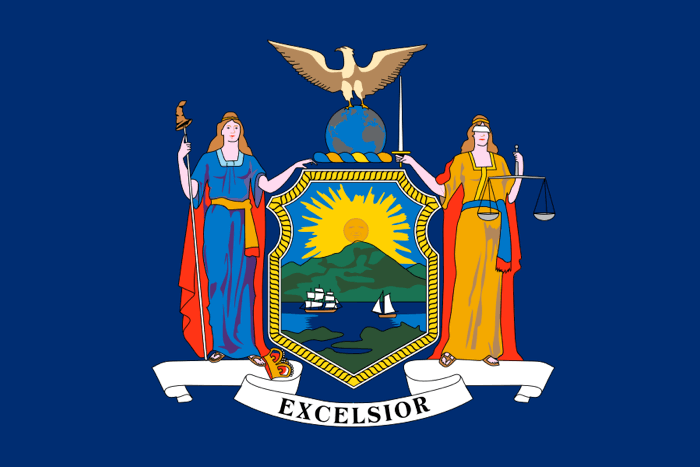

| New York | 21 | 21 | 18 |

| North Carolina | 21 | 21 | 28 |

| North Dakota | 18/21 | 18/21 | 18 |

| Ohio | 18/21 | 18/21 | 18 |

| Oklahoma | 18 | 18 | 16 |

| Oregon | 21 | 18 | 18 |

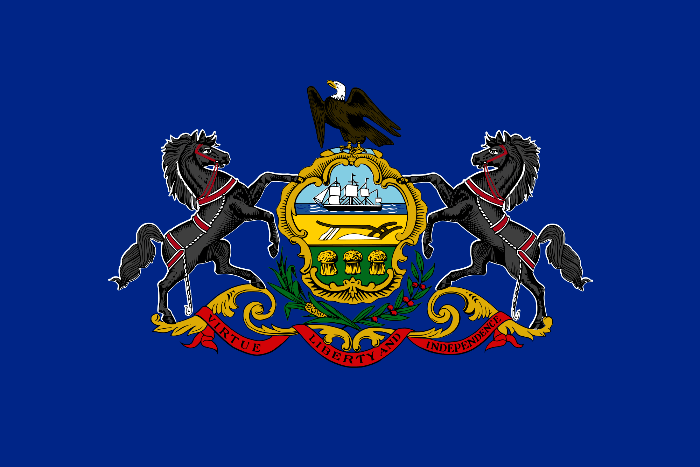

| Pennsylvania | 21 | 21 | 18 |

| Rhode Island | 21 | 21 | 18 |

| South Dakota | 18 (Indian Casinos) | – | – |

| South Carolina | 21 (Cruises) | 18 | 18 |

| Tennessee | – | – | 18 |

| Texas | 21 | 21 | 21 |

| Utah | 21 | 21 | 18 |

| Vermont | 21 | 21 | – |

| Virginia | 21 | 18 | 18 |

| Washington | 18 | 18 | 18 |

| West Virginia | 21 | 21 | 18 |

| Wisconsin | 21 | 21 | 18 |

| Wyoming | 21 | 21 | 18 |

How old do you have to be to go to a casino and how old do you have to be to gamble are two different questions. The reason is that some casinos don’t have any restrictions when it comes to casino visitors, as long as they don’t gamble. What this means is that in some gambling establishments, children are allowed to walk around (accompanied by their parents) the premises.

Gambling age, however, is a completely different thing. In order to be permitted in the gambling area of a casino, you need to be of legal gambling age. The obvious question at this point is how old do you have to be to gamble?

The answer is that it depends on your state. In most gambling-friendly states, the youngest age to gamble is set to 21. Currently, there are 35 states that belong to this category. There are also a couple of states where the minimum age to gamble is 18.

Moreover, there are some states with the so-called 18/21 gambling age rule. What this means is that even though people aged 18 can gamble, they cannot visit casinos that serve alcoholic drinks as the legal drinking age is 21. In some states, however, 18-year-olds are allowed to participate in only certain types of casino games, e.g., lottery and parimutuel games.

Online Gambling in the United States

There are only four states in the US that have made online casino gambling completely legal. Those states are New Jersey, Pennsylvania, Delaware, and West Virginia. If you live in one of those states, you have every right to play online slots, internet roulette, and all the other games offered by online casinos available in your area.

These four states have also made online poker legal and regulated. Another state that’s done the same is Nevada, which still continues to prohibit online casinos in order to protect its land-based casinos along the Las Vegas Strip.

When it comes to the states that are explicitly against online casino gambling, two that stand out are Utah and Hawaii. Although no one can predict the future of gambling, we’re pretty certain that online casinos aren’t going to get legalized in these two states anytime soon.

Most other states, however, have a sort of neutral relationship with the internet gaming industry. In a majority of states, online gambling remains neither legal nor illegal. In most cases, gambling online is not an offense if done at a licensed internet casino.

MobileCasinoParty Recommended Online Casinos

400% Up To

$4000$20 Minimum Deposit

25x Wagering Requirement

No Maximum Cashout

Free Spins on Pig Winner

- Welcomes USA Players

- Friendly Mobile Site

- Progressive Jackpot Slots

- Great Player Experience

- Many Banking Options

- Best Casino Bonuses

300% Up To

$6000$10 Minimum Deposit - Neosurf

$30 Minimum Deposit - Credit Card

30x Maximum Cashout

35x Wagering Requirement

- Large number of jackpots

- Massive welcome bonus

- Excellent mobile site

U.S. Casino States Frequently Asked Questions

Most US states have casinos within their borders, whether it’s commercial casinos, tribal casinos, racinos, riverboat casinos, bingo parlors, or some other types of gambling establishments. The only states without any gambling venues are Utah and Hawaii.

You can check out the page discussing the gambling laws of your state at MobileCasinoParty. At the bottom of the page, you will find a map with the coordinates of all the land-based casinos in the area. If there are no operational casinos in your state, the map will show you the nearest casinos located in neighboring states.

The minimum gambling age in Vegas is 18 years. Persons under 18 are permitted to enter certain Las Vegas casinos, albeit only if accompanied by parents. Children are not allowed in the gambling areas, but only in restaurants and other non-gambling parts of the venue.

Yes. In order to play any game you’ll have to exchange your money for chips (tokens) at a electronic cashier station, from a dealer at a table, or at the casino cage. You may also play with cash at the slot machines where a voucher will be printed when you cash out. Chips are freely interchangeable with money but don’t have any value outside a casino. You can however use them as tips.

If you are going to gamble this is a great way to get points exchangeable for money, coupons for games and buffets, or free slot spins. Not using a players club card is wasting the chance at a lot of extra comps. It also gives the casino a chance to track highroller’s play and issue win/loss statements.

You will be submersed in the total experience staying just a couple of feet away from the restaurants, nightlife, shows, and the games. Also comps can usually be applied to your room making it less expensive than most think.

In the majority of the casinos across the states, mobile phones are allowed, but taking pictures of the games is not, therefore security may ask that you not use your phone while on the gaming floor.

Yes, the dealers can explain the rules of any game, while pit bosses can explain regulations and rules and how they are rating your play. The staff is there to help you!

Anywhere in Las Vegas if you are playing, defiantly yes. Elsewhere some casinos are not allowed to serve alcohol to people who are gambling. Most that do serve will offer free drinks to their players. Don’t forget to tip and make sure that you are careful with your consumption, as you want to win money, not lose it due to not thinking clearly.